Can you think of any business paradigms that have stayed the same over the past 100 years? These days we run our businesses differently, with new models of hiring, training, leading, and executing; we have the use of unimaginable amounts of information and search capability to connect with new people and ideas. We now care more about diversity, gender and racial bias, and collaboration. We are far more visible, know our competition better, have greater reach, and possess an astounding capability to develop new solutions from any materials, from anywhere in the world that our imaginations can envision.

Can you think of any business paradigms that have stayed the same over the past 100 years? These days we run our businesses differently, with new models of hiring, training, leading, and executing; we have the use of unimaginable amounts of information and search capability to connect with new people and ideas. We now care more about diversity, gender and racial bias, and collaboration. We are far more visible, know our competition better, have greater reach, and possess an astounding capability to develop new solutions from any materials, from anywhere in the world that our imaginations can envision.

For centuries, sales has focused on placing solutions by seeking buyers with needs. Yet the environment buyers buy in has changed. Even with our new technology that finds, targets, and pursues a higher level of probable buyers, we’re closing less due to both the complexity of business environments and the stakeholder involvement in buying decisions. No more single decision makers; stakeholders have a say in all decisions; the buyer’s system – the rules, criteria, history, relationships and politics – is complex and must be taken into account before anything is purchased. As a result, since the 1980s when I began training sales people, closing ratios have gone from 8% to 5%.

YOU’RE FINDING THE BUYERS YOU SEEK

Believe it or not, you’re losing sales as a direct response to the way you’re selling. Your focus on finding ‘needs’ and placing solutions is limiting your audience to those who have already become ‘buyers’, which doesn’t occur until people are three quarters of the way through their buying decision path – a fraction of those who can/will buy.

Since its inception, sales has maintained the same focus – entirely appropriate until the days of global connections – and overlooked the change issues all people must manage before even identifying as buyers. And for some reason, even with the obvious decline in numbers (and increase in effort), we haven’t changed. Indeed sellers keep finding new ways to push every which way, becoming so desperate to close that you’re willing to lie, or hire 9x more sales staff, or wait months or years to finally close a sale that could be closed in a fraction of the time.

Has it never occurred that just maybe the 5% close rate is an indication of a problem? Would you go to a doctor with a 5% cure rate? Or fly a plane with a 5% safety rate? Why should sales be any different?

Indeed, even though your solution/product is most likely terrific, it gets lost in the inefficiency of the sales model: people who need your information aren’t reading it; people who would be helped if they purchased your solution aren’t buying. The problem is not the buyers or your content or your solution. The problem is the sales model itself; it’s so critically outdated and so mistakenly focused that you can’t ever get appreciably more closed sales.

- You’re aiming at the wrong goal (Do you want to sell? Or have someone buy? Two different activities.), using

- the wrong criteria for discovering a buyer (First criteria is ability to change; people aren’t buyers for first ¾ of the buying decision path.),

- the wrong reason to approach/find someone (Seeking someone with a ‘need’ means you’ve got to be RIGHT THERE the very moment they become buyers, severely limiting the scope of possibility and ignoring those en route to buying who aren’t ready to read your messages.),

- using the wrong skill sets (Questions and data gathering based on trying to sell or find a ‘need’ biases the process to those who are ready NOW, and ignores the Pre Sales stages of buying or promoting Buyer Readiness.),

- with the wrong people (You’re connecting with a fraction of the stakeholder team involved in buying in to a purchase.)

- and making the wrong assumptions about needing to build relationship (Really? Because you and everyone else tries to ‘make nice’ and attempt a fake ‘relationship’ they’ll buy? How’s that working for you?) .

In a nutshell, you’re entering with the wrong focus, at the wrong time, with the wrong criteria and faulty tools, connecting with the wrong people, and closing a fraction of what you could be closing. It’s really easy to add some new skills to what you’re doing and change the equation. You could be closing 40% of the lists you’re now using, but not by using the sales model alone.

NEED IS THE WRONG FOCUS

The way you’re selling, regardless of the new tools for targeting and visibility, guarantees you can’t close all the sales you deserve to close because your focus restricts your buying audience to those ready, willing, and able to buy and are seeking the information you offer. And that’s fine – if you are happy with a 5% close rate (which means you’re wasting 95% of your time). But you can be closing 8x more. In pilot studies, folks who added my Buying Facilitation® model to the front end of their sales process closed 40% using the exact same list and product as the control group.

I’m curious: when was the last time you responded to a pop up, or a spam call? Why are you ignoring them? The products they’re selling are fine – you might even need them. How ‘bout the last time you went onto a gym website and read the content – all the course descriptions, trainer descriptions? Was it prior to your decision to join? Or did you just go on to read the content because you had nothing else do to even though you could lose 10 pounds and might need for a gym? So… given possible needs, you’re not reading the content being sent even though it’s been targeted for you? Hmmmm… maybe a need is not the criteria needed to buy?

One of the causes of lost or inadequate closed sales is your focus on finding buyers with a ‘need’ to sell your solution to. Here’s what’s wrong:

- Finding buyers: People don’t become buyers (step 10 of a 13 step decision process) until they have discovered they cannot fix a problem with known resources, and gotten buy in from stakeholders for change. No, not buy-in to buy your solution. Buy in to change. Because adding something new means the status quo shifts, and people’s jobs and relationships change. The time it takes for every element and person who will be touched by the final solution to buy in to change (i.e. bringing in a new solution) is the length of the sales cycle.

- Need: if the proposed buyer hasn’t yet fixed their problem, it’s because it’s either A. built into, and accepted by, their status quo and the ramifications of change are too considerable; B. being worked on; or C. they haven’t gotten the buy in. Need is never the issue. They only need to find excellence, and if your solution is the best vehicle to get them there with the least disruption, and everyone agrees, they’ll buy. Your solution is merely a means to an end, not the end itself.

- Sell solution: sales is so hell bent and habituated on placing a solution that it’s willing to overlook the crazy of how much failure is involved. Seriously? Hasn’t it become obvious that seeking someone with a need, trying to place a solution, is getting you less and less success?

Over the decades you find better and better ways to sell less, and yet you continue to use the same organizing factors of solution placement based on need. Has it not occurred to you that it’s not working? That just maybe you might try something different like, oh, I don’t know, maybe focus on facilitating the comprehensive buying decision path? Maybe realize that without buyers you can’t sell anything? Because the truth is, selling doesn’t cause buying.

WHY PEOPLE BUY

People buy your solution because they want to effect positive change, and they can’t do it using the resources in front of them. And it’s only once they’ve done the internal, idiosyncratic change work necessary to get the buy in – STRATEGIC – are they willing to bring in an external solution (i.e. buy). And your great solution, your terrific content, your nice personality and fake relationship – your TACTICAL approach – isn’t noticed or welcome if their status quo will be broken beyond repair if they buy, or if the cost of the addition is greater than the cost of the status quo.

In other words, people don’t buy because they have a need. They buy only when they need a different form of excellence that they cannot achieve without something from the outside – so long as whatever it doesn’t cause irreparable disruption (for systems theorists, this is called Systems Congruence).

I have a brief story I often use to explain this. Years ago I was training Buying Facilitation® at IBM. I was asked to speak with a customer who had an old version of a new system they’d just developed and they needed a local beta test site. In exchange for being a beta, the client would get to keep the new hardware for free. And my client knew the old version and model the client had purchased years before couldn’t be working effectively given the way the company had grown.

Two sales folks had already called on this client, and the client said ‘no’ to both. They asked if I could give it a try. Here was my conversation:

SDM: Hi. I’m Sharon Drew Morgen calling from IBM. I’m wondering how your current system is working.

CLIENT: Well, it’s ok. [Odd. They turned down a free brand new, fast, system and weren’t ecstatically happy with the old one?]

SDM: I’m confused. I heard that we offered you a brand new system that would be much faster than your current one. What stopped you from taking it?

CLIENT: Dad

SDM: Excuse me? Dad? Could you explain?

CLIENT: Sure. We’re a Mom & Pop shop, and Dad is Pop. He’s 75 now, and he’ll retire in about 2 years. He handles all of the technology, so I don’t want to confuse him or upset him. He might as well keep doing what makes him comfortable, even if our system is a bit slow.

SDM: So Dad’s comfort is your criteria. From what I know, users find the new system as easy to use as the old one. What would you need to know about the new beta to know if it’s easy enough for Dad to stay comfortable?

CLIENT: Dad would have to try it and be comfortable with it.

SDM: We happen to have another beta site about a mile from you. Would you be willing to have me come by and pick you and Dad up for a trial?

And so we placed the beta. It had nothing to do with need, and everything to do with the system, the change management issues, the buy in issues.

Buyers don’t need your solution. They need excellence. 100 years after Dale Carnegie used ‘need’ as the criteria [and in 1937 it was!], ‘need’ is no longer the reason people buy. In fact 80% of your current prospects will buy your solution within the next 2 years (probably not from you) once they’ve gotten their ducks in a row. Which means they were always buyers, but not ready or able to buy. And instead of facilitating their buying decision (not possible using need or solution placement as a focus), instead of helping them find their own best answers, you spend your time and focus on need, demographics, and targeted marketing campaigns that couldn’t convince them.

YOU DON’T BUY THE WAY YOU SELL

Take a moment to think how you buy. Do you wake up in the morning after a wild dream and go straight to a Porsche showroom and spend $100,000 on a car that sort of looked like the one in your dream? Of course not. You think about it, discuss it with your spouse, talk to friends, go online, find out how much your car is worth to sell, look at your bank account, consider your timing. If you did take yourself to the dealership the first moment you thought about it odds are you wouldn’t have made a purchase that day until you did all of the other background work.

Same with your workplace. Are there communication problems? Leadership issues? Motivation, diversity, personnel issues?? Why hasn’t someone hired a consultant to help you fix it? You’ve got a need – but someone, something assumes you can either fix it yourself, or there are budgeting issues, or it’s not a big problem, or or or…

Since its inception, sales has overlooked the change issues all people must manage before even identifying as buyers – and continues to blame buyers for not knowing they need to buy. Has it never occurred that just maybe the 5% close rate is an indication of a problem?

A buying decision is a process that begins with some sort of stimulus, goes through a few rounds of discussion and examination against the rules, values, and stability of the status quo, some rounds of fixes with workarounds or tech solutions, some understanding of the downsides of change and consideration if the change can be tolerated or managed, and ultimately an agreement and considered preparation among all stakeholders that confirms they’re ready for something new to enter – the 5%, the low hanging fruit that finally, finally have completed their Pre Sales/change management work and become buyers. And yet you continue pushing pushing pushing your solution every which way in the hope that this set of words, this pitch, this website, will influence/inspire/manipulate/persuade people to buy.

Given that a buying decision is a change management problem, unless there buy in by all stakeholders, unless they are certain they cannot fix the problem with a known solution, until they are certain the new solution won’t cause irreparable disruption, people cannot buy regardless of their need or the efficacy of your solution:

- STAKEHOLDERS Along every buying decision path, there is a larger, more diverse stakeholder group than ever before; they all must buy-in to change, new decisions, or new purchases to make sure anything new coming in maintains the integrity of the system it will fit into. Because it’s a change management issue, the sales model is inadequate;

- WORKAROUNDS Options for workarounds, partnering, or technology fixes that didn’t exist before can potentially take care of a prospect’s problems without buying anything. Until they ascertain through trial and error that a workaround doesn’t exist, they’re not buyers. The time it takes them to figure out if buying something external is obligatory AND will comfortably fit within their system is the length of the sales cycle. We can help them reduce this time dramatically, but the sales model doesn’t do this;

- DISRUPTION The last thing – the last last thing – anyone wants is to buy something, as it reconfigures their status quo and causes disruption. Yet we’re not helping them navigate the change issues that come up when bringing in (buying) something new. This causes us to sell to the low hanging fruit – that 5% who have already determine they need to buy. Those en route, or who will become buyers when they figure it out (a whopping 40% of your lists are real buyers that aren’t even aware they might need you and ignore your information because they don’t yet recognize it’s important for them), are ignored because the sales model doesn’t address change facilitation;

- INFORMATION You spend time and a whole bunch of money finding best practices to push information, desperately seeking (and paying for) the ‘right’ words, offered in the ‘right’ way, to the ‘right’ people, attempting to match their unknowable criteria, and being ignored a whopping, whopping percent of the time. In a nutshell, you’re using your own selling patterns and touching only those whose buying patterns match your selling patterns, alienating or entirely missing some who might soon buy;

- CHANGE MANAGEMENT Buying is a change management problem, not a solution choice issue. But the sales model only sells to those who have already mapped out their route through the changes that will occur with a purchase. You are ignoring an entire subset of real buyers you can facilitate through change with a new skill set;

- RELATIONSHIPS You mistakenly believe that a good ‘relationship’ will entice buyers because you seem to show up, I don’t know, more professional? Nicer? How’s that working for you? Everyone tries to be nice!

- STEPS TO CHANGE There are 13 steps in a buying decision and people don’t identify as buyers until step 10. Since there are specific systemic tasks to be accomplished before getting buy in to make a purchase, these folks aren’t buyers yet, and as such, have no interest in your product content. Remember: if they cannot manage the change, they cannot buy regardless of their need or the efficacy of our solution. The current sales model disregards the change management portion where 8x more real buyers live. It’s a great opportunity to sell without competition: they’re now doing these tasks without you. Might as well be with you.

- BUYING DECISION TEAM There is always, always, some sort of Buying Decision Team (BDT). Whether a colleague, a friend, a partner or a team, the BDT are those involved with addressing the systemic issues that are quite personal, and outsiders can never understand regardless of need or the efficacy of the solution;

- WRONG FOCUS It’s possible to recognize a buyer on the first call by shifting your focus from ‘need’ and ‘place solution’ to ‘ability to change’. Note: since the first 9 steps have absolutely nothing to do with need, your current strategies can never find these folks.

- DISRUPTION People aren’t buyers if any disruption from adding your solution costs more than buying anything; it’s possible to add a few skills and help them figure out how to manage any potential disruption en route to become buyers. You’re waiting and pushing and waiting and pushing, only to waste 90% of your time. You might as well try something different.

- CURRENT SKILLS Because sales focuses on placing solutions, it doesn’t employ change facilitation skills that lead people who WILL become buyer through the steps of change. Again: they must do this anyway, with you or without you. Sales uses the wrong questions (biased by your need to sell), the wrong listening (listening through filters biased by what you want to hear), the wrong assumptions (that need=buyer), the wrong focus (place solutions) and the wrong outcomes (5% close, and lots of annoyed people who might have bought). More on this below.

- OUTSIDER STATUS You can never understand the specific politics or relationships going on in buyer’s environment because you don’t live there. Once they become buyers, of course you can understand how your solution matches their need. Before then, you can never know their historic relationships, problems, experience, or politics. Even if you attempt to query these you can’t ever have the same reference points to ask from, nor the appropriate unbiased listening filters to listen through. At the change management end, your current skill sets are useless.

- BUYING PATTERNS VS SELLING PATTERNS Buyer use their own buying patterns; sellers use their own selling patterns (email/content marketing, websites that only offer fill-in boxes rather than phone numbers, pitches, information-push). People buy using their own buying patterns, not your selling patterns.

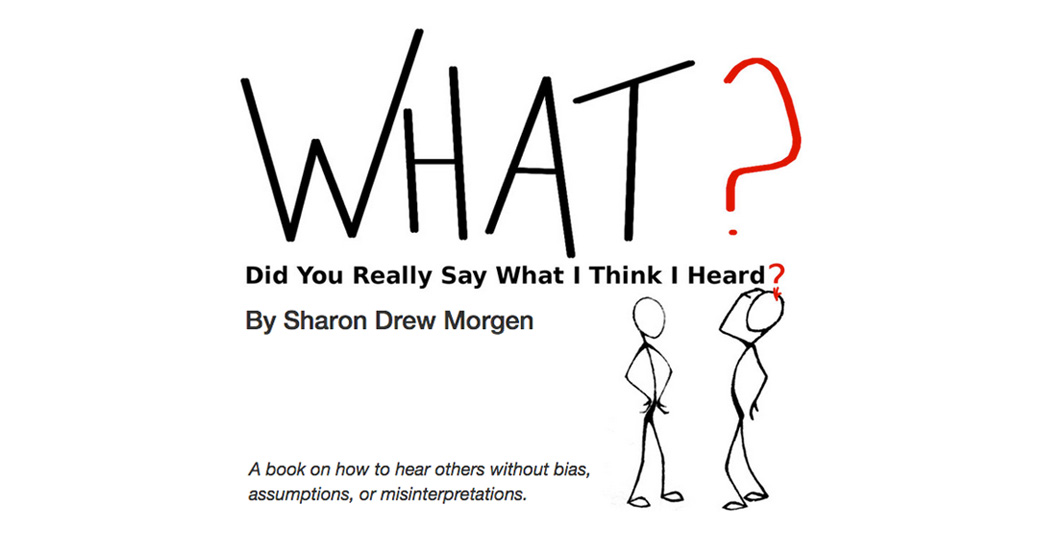

Here’s a wrap up of why your selling doesn’t cause buying: Besides narrowly listening for an inkling of ‘need’ (I wrote What? Did you really say what I think I heard? to teach you how to listen without bias), you’re overlooking the systems elements that must be managed before anyone can buy anything. You’re an outsider, using biased languaging, questions, and assumptions; your pitch merely represents what YOU think will inspire them to buy. But all that does is find those who 1. Have already done their Pre Sales change work, and 2. Seek exactly what you’re selling; it overlooks those who will shortly become buyers once they’ve traversed their route to congruent change. Got it?

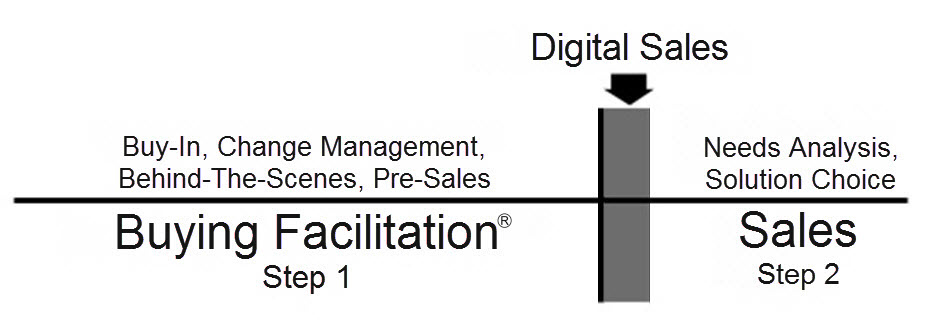

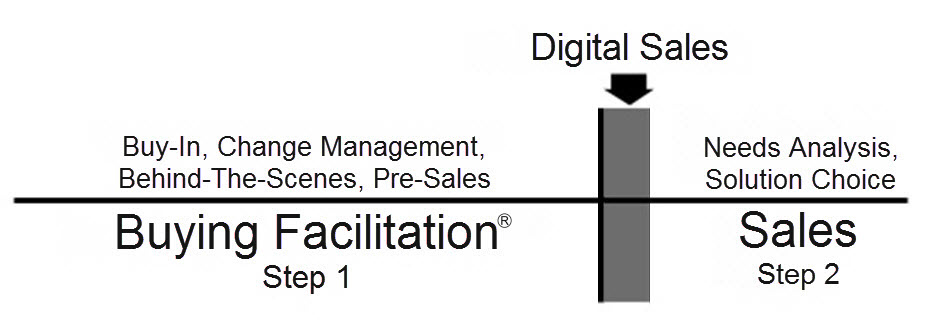

ADD BUYING FACILITATION® TO YOUR SALES PROCESS

I invented Buying Facilitation® and successfully trained it to over 100,000 people in global corporations with consistent results. It is not sales. It does not focus on finding buyers but in facilitating those people who WILL become buyers down their decision steps so they can do what they need to do to be ready and able to buy. Using Buying Facilitation®, Kaiser Permanente went from 110 visits and 18 closed sales to 27 visits and 25 closed sales. You choose which is more effective.

As part of Buying Facilitation®, I developed a new form of question (Facilitative Question) that eschews information gathering or the Asker’s curiosity and instead uses brain science in conjunction with the steps of decision making to lead people through to congruent change. I also developed a new way to listen (see my book What? Did you really say what I think I heard?) that avoids bias and listens for systems. And I shifted the opening focus from ‘need’ to finding those who are willing and able to change – in the sphere I’m selling in, of course. I’m facilitating those who can/will buy to Pre Sales Buyer Readiness.

Buying Facilitation® works with marketing as well.By understanding all elements necessary in the buying environment of your industry, you can write articles that move prospective buyers through their decision path using the steps of change, not with product content, but with change thinking. To find an audience for my listening book, I wrote an article on meetings, for example, because I know the steps of groups needing communication tools. I got dozens of Thank You notes from team leaders who shared the article to hundreds of employees, giving me a 54% conversion rate. And I did not discuss my book or even mention it until the footer.

As long as your sales model is focused on placing solutions and searching and listening for need, you will only close the low hanging fruit – those who have done their change management work, know a new solution won’t change their status quo beyond repair, and have gotten the buy in to proceed. It’s time to add Buying Facilitation® to the front end of sales, sell 8x more, and really help buyers buy.

For those of you who want to read more about this, here are some articles I’ve written:

The Real Buyer’s Journey

Do you want to sell? Or have someone buy?

Sell to those who WILL/CAN buy

Buying Facilitation® and Sales

How, Why, and When Buyers Buy

Why We Get Objections

If you’d like to discuss this with me directly, call or email: 512 771 1117; sharondrew@sharondrewmorgen.com.

____________

Sharon Drew Morgen is an original thinker, sales thought leader, and NYTimes Bestselling author of Selling with Integrity, and Dirty Little Secrets: why buyers can’t buy and sellers can’t sell. She is the inventor of Buying Facilitation®, a skill set that facilitates decision making along each stage of the Pre Sales buyer’s decision path, and assembling all decision makers and addressing all elements subject to change, pre purchase. Sharon Drew has trained global corporations, using pilot studies that consistently prove that adding BF to sales is 8x more effective at closing sales. Sharon Drew is also the thought leader behind the game changing book What? Did you really say what I think I heard? Sharon Drew speaks, trains, and consults in Communication, Sales, Listening, Buy-In. She can be reached at sharondrew@sharondrewmorgen.com.

Sharon Drew Morgen December 10th, 2018

Posted In: Sales

Because of your sophisticated tracking and targeting, you know who’s reading your content. But do you know why they’re reading it? And how are you accessing those who could/should buy but are ignoring the articles your sending them?

Because of your sophisticated tracking and targeting, you know who’s reading your content. But do you know why they’re reading it? And how are you accessing those who could/should buy but are ignoring the articles your sending them?

Content is written with different reasons in mind: for Buyer Personas to learn about your solution as early along their decision path as possible; for brand recognition; to gain followers; to make a sale. We write with a narrow focus to reach our target market and use every means at our disposal to distribute and track it, hoping that it will help us make a sale or find more followers.

DATA VS DECISIONS

But how do you know if this content, with these ideas and these words, written in this style, will enable those seeking a new solution to recognize they need you? Not only are you seeking a reader you can’t fully know (Why are they reading the content? No. Really. Why? And how many possible buyers reject it because they’re not ready yet?), you’re hoping, guessing, tracking, targeting, and crossing your fingers in hopes it will get into the right hands at the right time to take action.

But your glorious content – sometimes little more than a thinly veiled advertisement – may not be getting you all the success you deserve. You have a ceiling of a 5% success rate (less than 1% for content marketing) because you’re limiting your readership to those who have already decided on their next actions. By sticking to data push, you’re missing an opportunity to make your content an interactive experience that enable the act of decision making. With a few adjustments, you can create content that can be used to facilitate a sale and expand and enlist your audience.

The problem starts with the use of content marketing as part of your sales/solution placement toolkit. Certainly content marketing is great for explaining, pitching, writing about, introducing, and presenting data about our solutions. But this usage limits our target audience to those who are ready to buy, and are also perusing competitive data.

When you think about the early activity within the act of buying – the Pre-Sales, change management, decision issues that include 13 steps to consensus/action (9 of which are Pre-Sales and not ‘needs’ or ‘buying’ related) – there’s a huge swath of prospective buyers who aren’t reading your content as it is because they’re not ready, but could easily be made ready with content that fits into the route of their Pre-Sales change management decisions. You can develop different types of relevant content so you’re with them each step of the way, even before they’re aware they might need you.

See, prior to deciding on a solution, buyers have some change work to do that’s systemic in nature and vital to them maintaining Systems Congruence – the rules, initiatives, relationships, and history of their culture and environment. They can’t just wake up one day, see your content, and drop everything and everyone mindlessly to do what you want them to do. No one buys like that.

Thinking that a prospective buyer ‘needs’ your content, or will be convinced or influenced to take action before they’re ready, is magical thinking and needlessly restricts your audience. Obvious, no? Before anyone buys anything they do research, get input and alternate ideas from friends/colleagues, discern the potential fallout, trial different possibilities, and ultimately get agreement to move forward. You content is only relevant when they’ve handled all of this. By pushing your message, you’re restricting buying. You can use content marketing to facilitate the process.

CASE STUDY

When it was time to begin marketing my book What? Did you really say what I think I heard? I had a problem. Known for my Buying Facilitation® material in the sales industry, I had no obvious audience in communication or listening. I had to attract a new audience: find new readers AND shift from being a ‘sales’ expert to a ‘communication’ expert. My goal was to offer corporate teams a one-day Listening Without Bias training. To do that I needed readers to first buy my book.

Realizing I’d need buy-in to run an in-house program, I wrote an article that would attract the largest population of readers because of the universal problems involved: meetings. I wrote a very helpful article on meetings that offered both a clear description of the inherent problems and offered very creative, tough, usable solutions to make them creative, collaborative, and results-oriented. I never mentioned anything to do with listening. There was no manipulation or commercial overlay in the article, no links to listening/book links appeared only in the footer.

I got dozens of ‘Thank You’ notes from readers I’d never heard of, saying they’d sent/shared my article among hundreds of employees, friends, and colleagues. Many, many people shared the article on social media, bringing me new readers and subscribers outside my natural market. The article was ranked as one of my best-read articles, with thousands reading it the first few days. And my book sales went through the rood: I had a 51% conversion rate.

So yes, content is vital. But it can be read by more prospective buyers, earlier in their decision path. Start by understanding each of the Pre-Sales issues (i.e. systemic changed-based, not ‘need’ based or solution-based) your buyers must address with their colleagues and partners, and then write articles that will help them along their normal route to making the internal decisions they’d need to make before they can buy. Then you’ll have proven your worth and be familiar to them. By the time they’re ready to buy and have all their internal ducks in a row, they’ll seek out your content.

____________

Sharon Drew Morgen is an original thinker and visionary in systemic change in sales, coaching, leadership, collaboration, and listening. She is the author of 9 books, including Selling with Integrity and What?, as well as 1700 articles on buyer readiness, decision facilitation, and collaboration on her award-winning blog sharondrewmorgen.com.

Sharon Drew is the developer of the Servant Leader change model Buying Facilitation®, that gives sellers the tools to help buyers (and clients, and patients, etc.) manage their Pre-Sales/Pre-Change decisions. Sharon Drew has worked with many Fortune 1000 companies such as IBM, DuPont, Kaiser, Bose, and GE. She is a speaker, coach, consultant, and original thinker. She can be reached at sharondrew@sharondrewmorgen.com.

Sharon Drew Morgen April 16th, 2018

Posted In: Communication, Sales

I recently took a cold call from Comcast – the first cold call I’ve ever taken. With my two year contract just about up, I was interested in finding cheap deals moving forward. Here was the call:

I recently took a cold call from Comcast – the first cold call I’ve ever taken. With my two year contract just about up, I was interested in finding cheap deals moving forward. Here was the call:

Comcast: Hi Sharon. I’m Pete from Comcast, wanting to help you sort through your options with your TV programming since your current package expires in December.

SDM: Pete, my first name is Sharon Drew, never Sharon. Always both names, ok? Thanks. I was going to call you anyway. My free HBO and Showtime are expiring. Can you tell me how much will it cost me once they go up? Is there a different 2 year plan I can sign up for that would keep my rate about the same?

Comcast: Well, Sharon, I…

SDM: Excuse me, Pete. Sharon Drew. My first name is Sharon Drew.

Comcast: Um, ok. Well. I’m glad you asked. Given what you’ve got now, I think I can actually upgrade your programs and still save you money. We have a package that does X. It will give you XYZ, similar to what you have now with two added channels, but costs less.

SDM: What’s the downside? What do I gain? Lose?

Comcast: Everything is exactly the same, except you’ll get two more channels and pay less.

SDM: Exactly the same? Cheaper? More programs? Cool.

Comcast: Yup. Exactly the same and cheaper. I can send you the paperwork, and you can see for yourself.

He then texted me a link to a contract to pay; within the contract was another link to details. I clicked and noticed inconsistencies.

SDM: This is more expensive! You’ve unbundled each feature and charged separately, so I’d pay $45 more than if I just let my current deal expire in December.

Comcast: Everyone pays for those things. You couldn’t have Comcast if we didn’t offer those features.

SDM: That’s not what I said; and you’re making the argument murky. You said it would be the same and cheaper with two new channels. But it’s not cheaper; services are unbundled and charged out individually on top of the quoted rate, causing me to pay more than I would with my next contract. Sounds like you’re lying to me or at least trying to muddle the facts so it just appears that I’d be saving money. What am I missing?

Comcast: Silence. Silence. Click.

As my provider, as the company/behemoth to whom I give thousands of dollars annually, Comcast owes me honesty, no? And aren’t they big enough to not try to dupe customers who would have pressed ‘Pay’ without reading the ‘fine print?’ Surely lying can’t be the preferred avenue to successful upselling, although I’m sure sometimes sales folks ‘do whatever it takes’ to get the commission without the sanction of their supervisors. In this case I actually redialed Comcast and said I wanted to renew my plan. When the seller looked up my account, she did exactly what the first guy did – same promise, same spiel, same text/link. Sadly it seems Comcast is training their reps this way.

WHY BUYERS BUY UPSELLS

As vendors, our job is to serve our clients and customers; our products are the path to serving, so we’re a ‘customer service company that provides web design services,’ or a ‘customer service company that provides financial services.’ As such, answering questions and solving problems are part of the promise implicit in a purchase. [PERSONAL NOTE: Any time we betray our clients’ trust and don’t deliver on the promise inherent in their purchase, and any time we lie to our customers, they have the right to choose another provider who will be honest.]

One of our services is letting customers know when we develop an upgrade; our success at upselling depends on how we connect to inform them.

Who is a suitable buyer? There are two inbuilt problems:

- The only customers who will buy an upgrade are happy customers who already trust us and have taken us into their daily lives and habits. [Customers who don’t like our solution or don’t trust us will never buy again and aren’t prospects for upselling. Remember that, when designing customer support programs like help desks and call centers.]

- In the homes and offices of happy customers, our solution/service has become habituated; clients have developed a system of people, policies, behaviors, or habits that are in place when using the product and they’re doing very well, thanks.The problem is not in convincing them to buy a bigger/better add-on because it’s, well, bigger/better, but to help them figure out how to manage whatever change and disruption the upgrade would require.For example, if users are happily using the software they bought from you, they’d need to… to what? Take additional training and incur downtime? Face disruption that would carry a cost? Maybe buying newer services could cause more downside than upside. By merely focusing on features and functions, the real problem is overlooked: the focus of their objection is change.

The fact that they will be ‘better’ with an upgrade is most likely accurate, but beside the point. We each ‘know’ we’d be better if we stopped smoking/lost weight/jogged/meditated/were kinder, etc. But knowing isn’t the point. The problem is the change – the time, disruption, confusion, political or relationship risks, etc. – involved in altering an established pattern. (Note: I’ve coded the steps to congruent change to help you understand what buyers must do before they can buy.)

When we introduce and describe our new solutions, when we focus on introducing and pitching the value of our solution, we ignore the biggest factor that inhibits buying: as outsiders we can’t know how the purchase would affect the buyer’s environment and use routines – the relationships, politics, time factors, etc. – which may change, or might be perceived to change, with an upgrade. Before they buy, they must understand the extent of any disruption to determine if it’s worth it to them: a trouble-free working environment and nominal cost supersedes need. Remember: they find the current version ‘good-enough’ as it is; they have people and policies in place and have factored in the costs and resource. Habit and status quo may supersede benefits.

I’ve got a story. IBM was seeking local users of an old OS to place a new Beta test version, with a goal of visiting, testing, questioning, etc. There was a possible user right down the road and IBM was eager to enlist them. But three different sales reps tried to engage this user to no avail. Nope, we’re happy. Yes, our current OS is very slow and we understand this new, free, one would make our jobs easier and workflow faster. Nope. We don’t want the beta.

Since I was already there running a Buying Facilitation® training they asked me to try. The phone call follows:

SDM: My name is Sharon Drew Morgen and I’m calling from IBM. Is this a good time to speak?

CUSTOMER: Sure. How can I help you? [Note: I was fascinated that just about everyone took a cold call from IBM.]

SDM: I am following up from my colleague’s call re giving you a free beta OS, and I heard that you’re really happy using the OS you’ve got in place now. Seems it’s working really well for you and you don’t seem to mind its speed.

CUSTOMER: It is slow. But we like it.

SDM: What’s stopping you from considering adding more speed to the one you’re using now?

CUSTOMER: Dad.

SDM: Excuse me? Dad? What does that mean?

CUSTOMER: We’re a Mom and Pop shop. My dad is the Pop. He’s 75, and will be retiring next year. He’s in charge of the technology, and he’s not as sharp as he once was. We’re not going to add anything to his plate, and wait til he retires to upgrade whatever we need to.

SDM: Ah. That makes sense. I wonder how hard our new OS is to learn or use. I could find out. What would you and Dad need to know to be willing to experience whether or not the new OS would be simple enough, just in case there came a time when you wanted to accommodate all your new users?

CUSTOMER: I’d need to know that Dad would have no difficulty or confusion, and it would be easy and seamless to implement with no glitches.

SDM: We happen to have a functioning beta site for this product right down the street from you. Would you and Dad be willing to join me and visit them to try it out? Then, if Dad likes it and you find it more efficient, we could then discuss you being a possible beta site for us?

CUSTOMER: Sure.

It all went well, IBM got a new Beta test site and the customer got a free upgrade. It’s not about an upgrade; it’s about their readiness for change. And as outsiders, we can never know where a ‘Dad’ is and have no opportunity to lead them through a different decision.

Convincer and information strategies close the low hanging fruit. Each customer has unique ‘givens’ that have created and maintained their status quo; they’re not ‘stupid buyers’, they just must manage their own internal integrity. And the conventional sales approach assumes that the features, functions, and benefits will convince them to buy, ignoring the ‘how’ or ‘if’ or ‘why’ or ‘when’ to handle any disruption caused to their system by addiing a new element to their status quo with no route to address change for what’s already in place.

In summation:

- The target audience consists only of those who are happy using the solution they purchased (and that those who don’t would most likely never buy anything more);

- Conventional sales merely closes the low hanging fruit – those ready, willing, and able to manage any change inherent in an upgrade. Do blanket outreach with questionnaires, surveys, contests, prizes, to find these ready buyers, or find creative ways to target them specifically.

- It’s possible to facilitate buyers through their change process, as in the Dad story above, and broaden the buyer base.

What is the suitable vehicle? There are certainly several ways to facilitate upselling with integrity. When customers call in, ensure an integrous connection with someone or something in your company; provide a wonderful opportunity to exhibit respect and care. Each vehicle requires a different approach but includes the goal of facilitating change and managing the change-over to new routines.

OUTGOING UPSELL:

Cold Calling with Integrity: Happy customers have more of a willingness to take a call. Use this as an opportunity to serve them by facilitating change. I designed Buying Facilitation® to specifically facilitate the buyer’s steps of change and decision making; or design your own unique Change Facilitation model that quickly helps them think through routes to managing any disruption, and adds product pitch once the customer is ready. Remember: unless a prospect can positively address their change, use, and habituation issues, they will not buy regardless of need or the strength of your solution.

Email outreach: Current email blasts focus on introducing reasons to buy the upgrade. It’s possible to add ‘implementation features’ or ‘ways to get your cell phone recycled’, or ideas to mitigate whatever change your particular solution might incur. For this I recommend you research the routines and issues current customers face when using your solution. When researching this for my clients, I call several existing happy customers and ask the ‘how’ of their routines, and I include the Facilitative Question: What would keep you from adding an upgrade to what you’re currently doing successfully?

INCOMING UPSELL

Help desk: Currently, help desks suck. With a focus on time rather than service, we get customers enraged and frustrated. This is a wasted opportunity. When working with Quest years ago, we taught the reps to help customers figure out how and if an upgrade would serve them; we brought the help desk upgrade rate from $300 a month to $2100 a month per rep.

Tech support: See above: this is a great opportunity to serve. You’re wasting it by keeping people on hold and passing customers from pillar to post. Have ONE person own the incident to minimize the annoyance factor and use a Change Facilitation approach while on the phone. A great venue for upselling.

On-line chat: Reprogram responses to avoid the disrespect and annoyance that keeps customers from using this feature. Again, it can be a great opportunity for upselling if used correctly.

These are merely an introduction to ideas for more robust upselling. It’s possible to upsell a lot more than you’re now selling. Good luck.

____________

Sharon Drew Morgen is the developer of Change Facilitation models, including Buying Facilitation®, an addon to sales that leads buyers through their Pre-Sales steps to a purchase to enable Buyer Readiness. As an original thinker, she has written 9 books, including the NYTimes Business Bestseller Selling with Integrity and the Amazon bestsellers Dirty Little Secrets: why buyers can’t buy and sellers can’t sell, and What? Did you really say what I think I heard? Sharon Drew trains, speaks, consults, and coaches in the areas of sales, coaching, leadership, communication, change, buy-in, and influencing. She can be reached at sharondrew@sharondrewmorgen.com. Her award winning blog has original articles and essays. www.sharondrewmorgen.com

Sharon Drew Morgen November 6th, 2017

Posted In: Communication, Sales

In 1993, when my first book came out and before he died, David Sandler called to buy out my Buying Facilitation® model. We couldn’t agree on terms, but he was excited by my differentiation between the sales model and the buying process: “I recognized that the problem was on the buy side, and thought my Sandler method was thinking out of the box. Reading your stuff, I now recognize my focus is still on getting solutions sold,” he said. “I hadn’t realized that ‘outside the box’ meant to shift the focus first to facilitate buying. Well done.”

In 1993, when my first book came out and before he died, David Sandler called to buy out my Buying Facilitation® model. We couldn’t agree on terms, but he was excited by my differentiation between the sales model and the buying process: “I recognized that the problem was on the buy side, and thought my Sandler method was thinking out of the box. Reading your stuff, I now recognize my focus is still on getting solutions sold,” he said. “I hadn’t realized that ‘outside the box’ meant to shift the focus first to facilitate buying. Well done.”

And yet, after all these years, the problem remains: we’re limiting success and wasting an untold amount of resource seeking those few who are ready, willing, and able to buy: we’re missing a much larger, untapped market of potential (but real) buyers we ignore because our sales outreach doesn’t affect them. By broadening the goal to include facilitating change with those in the process of becoming buyers, by recognizing that a buying decision is a systemic, change management issue before it’s a solution choice problem, it’s feasible to engage earlier (albeit in a different way) and find a much larger population of real buyers.

HOW SALES RESTRICTS SELLING

The sales industry has a singular goal of placing solutions. It’s an industry with solutions looking for a problem. And the paltry results of a 5% close rate have been baked into the system: you accept low closing ratios as the best you can do, hire more sales people than you need, suffer from a sales cycle that is months/years longer than necessary, and lose buyers that will need your solution but don’t yet need or notice the information you provide.

Have you never asked yourself why, with all the capability of finding prospective buyers at your fingertips, you still close only 5% – down from 7% a decade ago (and with much less technology)? And why you continue to waste untold bazillions on staff, technology, and time, chasing folks who will never buy. Have you not recognized that

-

the people you target aren’t necessarily buying or buyers,

-

you’re expending too much resource on those who will never buy,

-

you don’t know the difference between those who will and those who won’t buy?

With the best technology available, the most professional branding and marketing, great content, and a good solid product, you’re losing far more sales than you need to. This much should be obvious: No matter how much new technology, or how many sales methods available to you – regardless of all the ‘new new’ things at your fingertips – you’re still merely closing the low hanging fruit (those 5% who have determined they are ready, willing, able to buy).

A buying decision is a change management problem before it’s a solution choice issue. By adding a few bells and whistles to your sales efforts you can find people who will be buying but aren’t yet buyers and facilitate their strategic Pre-Sales, non-solution-based decision path that concludes with them buying. Then you’ll close far more than you’re closing now with half the staff and half the time. But it needs different thinking.

SELLING VS BUYING

People become buyers only when there are no other options and a purchase is their last hope for problem resolution. They can’t even accurately define a ‘need’ until the full complement of stakeholders are involved and the scope of any resultant change is recognized. Sales ignores this group because their touch points are different and they are definitely not yet buyers. Yet it’s here they’re more open for support and connection: their path to congruently resolving a problem is confounding; they may forget to bring in “Joe from accounting”, or can’t recognize the full scope of issues until they’ve falsely started down one path to resolution and must start all over.

You’re a subject matter expert in the area of their problem resolution and could really be a support here – so long as you avoid trying to sell and focus on facilitating change first. This is where they will be eager to connect. By only focusing on selling/placing your solution, you ignore 40% of real buyers who haven’t gotten there yet but will.

Ask yourself this: Do you want to sell – or have someone buy? They are two different activities with different rules, needs, and behaviors. Sales is tactical. Buying is strategic. Your tactical focus on placing solutions with Buyer Personas, Opportunity Management, content differentiation, and yes, even Sandler, SPIN etc. offer biased questions and content focused on those few who have defined, and understand, their need and change issues, overlooking those people in the midst of strategic decision efforts who will develop into buyers once they get their ducks in a row. Sellers actually sit and wait while prospects do this anyway. Why not help them! Here what sales ignores:

-

A buying decision includes a 13 step change management process, the first 9 steps of which are systemic change (not purchase or need) focused; they aren’t ‘buyers’ until step 10 when all of their systemic/change management stuff is worked out, and there is agreement that a purchase is their only option.

-

A problem doesn’t equal a need; a ‘need’ doesn’t equal a purchase. It might turn out that maintaining the status quo is a better option for them; as an outsider, you can never understand why.

-

People aren’t buyers until they’re out of options to fix their problems themselves AND they’ve gotten buy-in to bring in a ‘foreign’ element. The last thing they want to do (precisely, the last thing) is to buy anything. The buyers you seek/find are already at the end of their decision path.

-

Your terrific content isn’t being noticed by people who haven’t yet determined, defined, agreed upon a ‘need’ even though they may become buyers later, or even really need your solution.

-

Your content/selling push assumes that with the right content and message, offered to the right demographic, at the right time, focused on the right need -> purchase scenario, you’ll get in/close – but you’re only reaching those few who are ready OR those in the midst of their research (who may never buy but may call you with questions or take an appointment). They won’t even read or heed your outreach.

-

You’re using a ‘need’ and ‘solution-placement’ filter which restricts your results 95% of the time, causing you (beyond all logic) to push push push push harder or better, against a closed system of people and policies that’s not ready, willing, able to buy.

The problem is not your solution (It’s great. And people can find the content they need on line when they’re ready.); the problem is that the sales model places solutions with people who need them, but does nothing to help facilitate the change elements people traverse en route to becoming buyers and are not buyers yet. Here are the main stages people execute as they seek to resolve a problem (The full set of steps are laid out in my book Dirty Little Secrets: why buyers can’t buy and sellers can’t sell.):

-

Assemble the full set of stakeholders (including “Joe in accounting”) who spend time understanding the scope of the problem, how it got initiated, and how it maintains itself;

-

Once a problem is defined by all stakeholders, the group tries to resolve the issue with familiar resources to minimize fallout. (This is where they might contact you with questions. They’re doing research, not buying.)

-

Once it’s decided to seek an external solution, they must find a route to resolution that maintains Systems Congruence. So if your users refuse new technology, or your teams function well as they are, you might find a way around a purchase if the disruption is too great. An Outsider can never understand the unique nature of internal dynamics. Can I ever really understand why you don’t stop smoking, or stay in a dysfunctional relationship, or stay in a job/relationship that makes you miserable? Change is always personal.

Notice how these stages are change- and systems-focused, and not accessible to Outsiders with a ‘sales’ hat on. And until they are addressed, there’s no ‘need’ and no ‘buyer’. Btw, I developed these stages decades ago; they apply to anyone making a decision including coaching clients, patients, and employees, and all buying situations regardless of the size of the change/purchase. Whether you merely need to buy a new phone, or go through a merger, the steps of change must be traversed in a way that maintains the status quo (even when it’s unconscious) regardless of need. You wait while people do this anyway; why not find those who CAN become buyers (rather than ‘should’), facilitate their change quickly, and be there with them as they buy – and be with them as they figure out their own unique strategies for change – so long as you avoid trying to sell anything as they’re not buyers yet.

Is it sales? No. It’s a Change Facilitation process I call Buying Facilitation®. By first enabling people to facilitate their buying decision path, you’ll have less competition, close more, stop wasting time selling to those who can never buy, and be true Servant Leaders; you can use your technology, your content marketing, your sales efforts as you are now, but with an additional focus.

WHY AREN’T THEY BUYING? SDM ANSWERS YOUR QUESTIONS

Using the above thinking, here’s a ‘Q&A’ to help you better understand why you’re getting the results you’re getting.

What’s wrong with seeking buyers to place our solutions? Isn’t that what sales is?

Sales is perfect for finding and educating buyers with a need, but not for facilitating the buying decision path. There’s a 13 step decision path between recognition of a problem and a purchase. Sales only handles the limited portion (steps 10-13) that occurs once people reach the point where a purchase is their only option AND they have buy in from the full complement of stakeholders for non-disruptive change (step 9) (Think about it. You won’t buy a new car, or a new X, until you’ve tried to fix the one you’ve got, AND you have the funds now, AND your spouse/team agrees, AND you’ll still function as well with the new item.). No Outsider can make these determinations, they’re not based on buying anything, and your content is irrelevant until then.

Why do they keep talking to me if they’re not going to buy?

Until the entire scope of change is understood and integrated, people don’t understand the perimeters of their need (and when you ask biased questions, the flawed answers you receive often cause you to chase those who will never buy). Before becoming buyers, people must recognize that the cost of change (buying) is less than maintaining the status quo: their ‘system’ is sacrosanct. Would you buy a new car if your spouse would divorce you? Would you bring in a new CRM system if half of your user team would quit, or refuse to use it, or until the tech folks have the time to implement? You know you have to go to the gym more, and eat/drink less. You’ve got a need. Have you signed up for the gym? Stopped drinking beer?

Why are we still getting such a low close rate when we’ve got so many terrific tools at our disposal to introduce our features AND find the right demographic?

Because only a small percent of people you focus on are buyers. Until they’re out of other options AND determined they must bring in something from outside AND have all of their internal ducks in a row, AND have buy-in (Buyer Readiness), your tools aren’t recognized.

Why do they keep talking to me if they’re not going to buy?

During their change process, people research all possibilities. Your solution may be one of them; they’re actually using you for reference to report back to their team, or to figure out their own workarounds, or mention to their current vendor. It’s possible to know on the first call who will be a buyer and who is merely seeking data that will never lead to a purchase – but not with a solution-placement focus.

Why don’t buyers realize they need our solution when it seems so obvious?

It’s only ‘obvious’ to you. The best content, the most relevant solution, will be ignored until they reach step 10 when they become buyers.

Why is the sales cycle so long when there is a solid need/solution match?

The time people take to figure out how to manage change congruently is the length of the sales cycle. As Outsiders, we can never understand the depth of the change management issues: Who is fighting with who? What is the tech schedule? Who will need to be let go? How do internal politics show up? How does their history/future factor in?

The system that holds the problem in place is much more powerful than any solution you can offer. They need buy-in from EVERYONE and EVERYTHING that created the status quo and will touch the new solution. You’ll never recognize “Joe from accounting” who is an unsung influencer, or the fight going on between the sales and marketing folks who need to share budget. It’s not about their need – until it is. And they can’t tell you because they don’t know, or they won’t have found the nut of the problem yet, or you’re asking the wrong questions biased by your need to sell.

Why do buyers make promises they don’t keep? Are all buyers liars?

Buyers don’t lie. The one person you’re speaking with is responding to your biased questions, getting out of the thrust of your sales push, and is giving you the best data they’re willing to give you, or as much data as they have at that point in their 13 step change path. Whatever data they offer is limited by their access to the full Buying Decision Team, and the stage they’re at in their change management. You are, after all, strangers approaching them with a solution placement hat on, asking the wrong questions to the wrong people at the wrong time. As an Outsider you can never, ever have a clue as per the political, personal, strategic decision issues they face. But you can understand they system they decide in, a per your expertise in your field.

Why isn’t our great content being read or acted upon by the larger audience who really needs it?

Needs it according to who? Your research? Your biased questions? Your focus on placing solutions limits your audience and keeps you from getting into the decision path earlier. Are they at the point of seeking workarounds? Is there a team buy-in problem? Have they forgotten to assemble some of the appropriate stakeholders? Are they finding a glitch (political, personal, management-based, etc.)? Your sales, marketing, content, and technology restricts your target market to the low hanging fruit who have clearly defined their need, know they cannot fix their own problem, and have a route to congruent change.

When I gather info about a need, and it seems obvious there is one, what am I missing?

You’re merely asking biased questions to elicit the data YOU want to elicit from one person or a few research visits to your site, to find people who SEEM like they have a ‘need’ and spend a lot of resource chasing after them whether they are real buyers or not. Plus, because someone has a need doesn’t mean they are ready, willing, or able to buy; because the one person on the team you’re speaking with does NOT seem to have a need, doesn’t mean they don’t have one. You’re a solution looking for a problem. Enter first with a Facilitator hat on, help those that CAN/WILL become buyers traverse the route to change, and THEN sell.

It’s not as hard as you think. I developed a new form of unbiased question (Facilitative Question) to facilitate change (part of the Buying Facilitation® process) and pose these down the Pre-Sales steps to help the ‘right’ people become buyers. Here are two examples of responses to a Facilitative Question used on a first call. I bet you can tell which one CAN buy:

SDM: How are you currently adding more tools and capability to your sales team for those times you seek to reach an expanded market?

SALES DIRECTOR #1: I read a couple of sales books annually. If I like them, I’ll pass them on to my sales managers and tell them to get the sellers to read them, and run meetings to discuss their takeaways [Note: this was a real response.]

SALES DIRECTOR #2: I’ve had a helluva time trying to find new tools to use. I’ve tried several, and keep getting the same results. I’d be glad to use something new if I could be assured it was really new, and it would work.

My opening FQ, different for each situaltion, begins by shining a light on the system the person is operating in, and provides an invaluable insight into the state of possible change. It also begins making the person a Coach/Witness to her own status quo by asking for an overview of the system. This particular FQ helps #2 take an unbiased view of how she’s managed change until now. Buying Facilitation® then proceeds down her change steps so she can address each step efficiently, with me by her side. Director #1 had a need, but wasn’t a buyer.

When I form a wonderful relationship with a potential buyer with a need, where does he go? He seems to take calls and stay in touch, and then disappears. Where does he go?

He was never a buyer. He either couldn’t get the buy-in from the Buying Decision Team (BDT), or came up with an alternative solution, or decided not to move forward because the cost of disruption was too high. He stays in touch as long as there is a possibility he needs to buy something (he hasn’t yet gotten team agreement or become a buyer), or so long as the data you’re offering is useful to their ultimate decisions. 80% of our prospective buyers will buy a solution similar to ours within 2 years of our connection. That means they had a need but couldn’t figure out how to congruently manage the change.

When I’m months into a sale, and everything that was going well suddenly stops, where did it go?

See above. The person wasn’t really a buyer yet or the team wasn’t bought-in to change.

Are buyers spending a lot of time trialing and speaking to other providers before they choose us?

Possibly. People research the best alternatives to managing change with the least disruption.

Why aren’t we more successful when we check that they’ve brought in all stakeholders and help them achieve buy in? That’s managing Buyer Readiness, no?

You’re an Outsider. You’ll never understand what’s going on; the questions you pose and the direction you offer are solution placement based; you listen with a biased ear, etc. (Seriously: Read Dirty Little Secrets then call me and I’ll teach you how to do it.) Did they bring in “Joe from accounting”? How are they managing the fight between sales and marketing? Oh – one other big reason: you’re merely speaking with one, at most two, people; you have no reach through the sales model to facilitate change. I can’t say this enough: you’re an Outsider.

If you start as a Neutral Navigator, listen for systems and facilitate them through their OWN decisions with NO BIAS to selling, you can quickly find and serve those who WILL become buyers and help them efficiently manage change. Using Buying Facilitation® KPMG went from a 3 year sales cycle to a 4 month sales cycle with a $50,000,000 solution; Wachovia small business bankers went from a 2% close over 11 months to a 29% close over 3 months; Kaiser went from 110 visits and 18 closed sales to 27 visits and 25 closed sales. By adding BF to their dummy terminals, Barclay’s helped customers define, and buy, the exact solutions they needed. Help them traverse their change path and sell to those who will buy.

Why don’t more people show up at appointments? Why are so many buyers reluctant to take appointments?

-

All of the stakeholders aren’t involved yet so they don’t even have a clear, complete description of ‘need’. Those who take appointments are doing research (and do WHAT? with your content) and haven’t gotten team buy-in, or the full decision team isn’t on board yet;

-

They know from the first moment of a call that you’ll be pushing YOUR solution and not facilitating them in discovering THEIR own solution. It’s only if you can be an asset to them that they’ll be willing to see you.

What’s wrong with trying to place a solution by ‘understanding need’, or creating a need, or selling?

You can do that, for those who are already buyers understand their need.

I’ve paid a fortune for technology, research into demographics, opportunity management software, scripts, and experienced sales folks – but I’m still not closing all I deserve to close. Why?

Because your efforts are focused on ‘buyer’ ‘need’, and neither of those necessarily correlate with buying anything for those who aren’t yet buyers.

How does Buying Facilitation® find, and close, more real buyers?

Buying Facilitation® is a Change Facilitation model that works with sales (and coaching, etc.) and includes Facilitative Questions, Listening for Systems, Presumptive Summaries – wholly different skill sets than sales, and includes no bias. It traverses the first 9 steps of change management, in the ares your solution operates in, beginning with immediately ascertaining who is set up to be able to buy, or has a possibility of systemic change and then teaches them precisely how to discover their path to change. By adding BF you not only find the right buyers, but teach those who may not have been able to buy how to facilitate change.

With Director #1 above, it would take so long to convince him that his plan was flawed, and then get the other managers who have complied with his plan to acceded to change, that it’s not worth the effort. BF progresses down the change steps and teaches them how to bring in the right people, discover if workarounds are worthwhile, and why they haven’t worked until now. Then it helps them determine how change would need to be addressed – and with BF you can do this on the first call. It will ignore the ones who will never buy, and help the real buyers be ready to buy. So much easier than finding those relative few who have already done this. And it’s much easier than it sounds: you’re just not used to it yet.

IN CONCLUSION

Here is a rule: as long as the sales model tries to ‘find buyers’ and ‘place solutions’, you’ll never sell to anyone other than those who have determined they’re buyers, leaving you continuing to push your solution into their closed system. You can

-

discover who is, or will be, starting down the journey that will lead to a decision to purchase something,

-

figure out, with a change management hat on, what the journey in your industry, and among your buying market, looks like (or call me and I’ll help),

-

then enter with those few on their change journey as they quickly (with your help) figure out how to manage stakeholders, buy-in, workarounds, etc. and become buyers.

By adding outreach, vocabulary, content, that first focuses on facilitating the buying decision path earlier you’ll enlarge your range of buyers by 5x. After all, people must do this anyway before becoming buyers; we might as well join them where they are and facilitate the right ones.

Call me. Together, we can create content, software, scripts to find the right ones – those who WILL become buyers – and facilitate them down their decision path toward effective change and buying.

____________

For more reading on the subject, here are some ideas: Practical Decision Making, Questioning Questions, Buyer’s Journey, Do You Want to Sell? Or Have Someone Buy? , Influencers vs Facilitators. Or contact me to discuss. Am happy to share what I know. sharondrew@sharondrewmorgen.com

____________

Sharon Drew Morgen is a thought leader and original thinker, as well as the author of 9 books, including the NYTimes Business Bestseller Selling with Integrity, and the Amazon bestsellers Dirty Little Secrets and What? Did you really say what I think I heard? She has designed a Change Facilitation process for sales (Buying Facilitation®), coaching, health care, leadership, change management, and influencing, training it to such companies as DuPont (8,000 people), KPMG (6,000 people), Wachovia, Kaiser, Cancer Treatment Centers of America, IBM, P&G, Sandler Sales, ATT, Bethlehem Steel, Sandia Labs. Her blog www.sharondrewmorgen.com is recognized as one of the top business blogs, with articles on decision making, listening, questions, sales, coaching, etc. She is a trainer, speaker, consultant, and coach. Sharon Drew can be reached at sharondrew@sharondrewmorgen.com

Sharon Drew Morgen September 11th, 2017

Posted In: Change Management, Sales

The hot new sales tool is Opportunity Management automation. Just another in a long list of New New Things that seem like THE answer to THE way to efficiently close more sales. But is it? Over the past 10 or so years you’ve tried Buyer Personas, Understanding Need, marketing automation, Relationship Management, Trusted Advisor, Challenger, Sandler, SPIN, and lots of technology to push content. All hoping hoping hoping that THIS is ‘the one’ that will help you close more. But you’ve ended up with the same 5% close rate you’ve had for decades (It used to be 7%, remember?), regardless of the approach or the way an opportunity is managed.

The hot new sales tool is Opportunity Management automation. Just another in a long list of New New Things that seem like THE answer to THE way to efficiently close more sales. But is it? Over the past 10 or so years you’ve tried Buyer Personas, Understanding Need, marketing automation, Relationship Management, Trusted Advisor, Challenger, Sandler, SPIN, and lots of technology to push content. All hoping hoping hoping that THIS is ‘the one’ that will help you close more. But you’ve ended up with the same 5% close rate you’ve had for decades (It used to be 7%, remember?), regardless of the approach or the way an opportunity is managed.

Don’t get me wrong: opportunity management apps help sellers optimize their time and track results. But to what end? The tools can’t close more sales if the opportunity itself is flawed. What if you could find more viable opportunities by expanding your definition of ‘opportunity’?

WHAT’S AN OPPORTUNITY?

As I’m sure you’re aware, an ‘opportunity’ is often not an opportunity at all, or has only a small chance of being one. What if buyers aren’t your target audience? What if the larger opportunity is in a different place along the buying decision journey?

With the sales model based on entry points of ‘buyer’, ‘need’, Buyer Personas, and ‘need/solution’ match it’s impossible to close anyone but the low hanging fruit – buyers seeking a solution. This definition

- restricts your close rate to those people or groups who have gotten themselves ready to bring in an outside solution (5% with sales outreach; 0.00059% of online marketing outreach) and are ready, willing, and able to buy;

- assumes that those with a seeming ‘need’ is a prospect (They’re not. ‘Need’ does not equal ‘Buyer’ – but you know that by now);

- focuses questions, content, and relationship-creating skills with a bias toward placing a solution (ignoring the vital non-solution, systemic, change management, Pre-Sales steps that have no relevance to, but precede, buying anything);

- doesn’t sort for differences between someone who is strategically en route to becoming a buyer vs someone you’ve determined SHOULD buy and has a 95% chance of NOT buying;

- uses tools to pushpushpush what YOU want to sell (into a prospect’s private, personal, closed system of cultural norms and givens that outsiders aren’t part of), and closing merely 5%;

and restricts you from finding those who WILL close, aren’t quite ready, and could use your help efficiently getting there. The confusing part for sellers is that these folks – these real, potential buyers – are off your screen: they aren’t buyers, aren’t seeking a solution, haven’t determined they want to buy anything yet, haven’t yet fully determined the scope of their need, aren’t attracted by your content.

And therein lies the rub: before people become buyers they merely want to resolve a problem in the most efficacious way and their route to competence is initially not directly related to what you’re selling. Before people become buyers, before there is a sales opportunity, they must first conclude there is absolutely no route to resolving their problems with known resources AND have a route through to congruent change – internal adoption, buy-in, Systems Congruence, and change management. The last thing they want to do is go outside their system to buy anything – they never start out as buyers until they run out of options to fix a problem themselves. By putting on a wholly different hat, we can find and facilitate the ones who will BECOME buyers and vastly increase our pool of opportunities. But we can’t use a ‘sales’ hat to find them.

CHANGE MANAGEMENT PRECEDES BUYING

A buying decision is a change management problem first before it’s needs- solution-based. Buyers are merely people who have gotten to the point in their change management procedures when an external solution (i.e. making a purchase) is their only viable alternative to Excellence. The fact that people have a ‘need’ that your solution can resolve does NOT mean they are, or will ever be, ready, willing, or able to buy. There is a 95% chance that those who seem like buyers aren’t buyers at the point where your content finds them. And sadly, your content won’t get them there: they won’t even notice it because they’re not yet looking for it even though they may eventually seek it.

It’s possible to shift the ‘opportunity’ criteria to people who WILL be buyers but aren’t ones yet – and know how to recognize real buyers from ‘tire kickers’ on the first contact; there are far easier entry points into a buyer/seller dialogue than what might seem to the outsider like a ‘need’.

Before becoming a buyer, or having a fully defined need, people traverse a specific path (I’ve spent decades coding and defining, training and testing, the 13 steps in a buying decision path, as explained in www.dirtylittlesecretsbook.com) between recognizing a problem, assembling the proper stakeholders to buy-in, managing any negative consequences of change, and deciding to make a purchase; they become buyers only at step 10 once they agree that making a purchase is their best option.

In other words, there are 9 non-buying change management (Pre-Sales) steps people take as they figure out how to congruently solve their problem and manage the change an external factor will cause. Using a Change Facilitation lens, with a bias toward the steps of congruent change, we can enter earlier to efficiently facilitate real prospective buyers and be part of their system as they begin the buying process. It’s possible to expand your criteria and tool kit to connect along different stages of the decision journey and recognize/facilitate exactly who WILL become buyers but aren’t there yet. But your initial focus must be systemic change, not selling. Different questions, different listening.

Using ‘need’ and ‘solution placement’ criteria, the only way to attract an opportunity is to find those relative few who have gotten to the point of recognizing they cannot resolve their own problem. Until then, they cannot buy: they haven’t fully defined a ‘need’, don’t have their full Buying Decision Team (BDT) in place, haven’t gotten buy-in, and aren’t actively seeking to buy anything. Selling is tactical: buying is strategic.

WHO IS A BUYER?

Think along with me for a moment. A person or group doesn’t become a buyer unless they’ve determined they cannot fix their problem themselves with familiar resources AND they are set up (environment, culture, technology, implementation, buy-in) to manage any fallout from having a foreign element (a purchase) enter their system. Maintaining Systems Congruence is vital; the last thing, literally, that a person wants is to buy anything due to the possibility of disrupting their status quo that is functioning ‘well-enough’. Indeed until they

- have a plan to manage their strategic, idiosyncratic, private activities and are convinced they will end up with Systems Congruence;

- have assembled their full complement of stakeholders and understand their full complement of buy-in and change issues (including ‘need’);

- are congruently ready to seek purchasing options;

they’re only ‘people’ meandering through a confounding route to Excellence, facing political issues, personnel/personal issues, buy-in issues, tech integration issues, etc. They’re not buyers regardless of what you consider to be an ‘opportunity’, how many appointments you make, or how well the folks like you. And the way sales is implemented and biased toward solution placement, the questions posed, the answers sought, you’re only seeking and attracting those who have already reached step 10 and consider themselves buyers.

What’s the difference between an ‘opportunity’ and one that’s NOT an opportunity?

- There’s no opportunity to place a solution with a prospect until they’vea. fully assembled their entire BDT including ‘Joe’ in the back office who you never get to speak with but who’s a huge influencer,

b. tried workarounds to fix the problem themselves with familiar resources,

c. fully recognized the change management issues that would potentially cause a breakdown should they bring anything in (buy something) without appropriate change management and

d. determined that the cost of a purchase is less than continuing their status quo.

- With a bias toward placing a solution, you try to ‘get in’, ‘find a need’ and ‘have a relationship’ based on your desire to sell, gathering biased, wrong or incomplete data, leading to false assumptions of Buyer Readiness. Until they’re buyers, they haven’t fully defined their need or what it would take to fix (although BDT members might research your solution or reach out to you to gain knowledge).